PROXY STATEMENT TABLE OF CONTENTS | | | | | | | | PAGE | | General | | | | 1 | | | | | | 1-2 | | | | | | 3-4 | | | | | | 5-7 | | | Say on Pay | | | | 8-12 | | | | | | 13 | | | | | | 13-14 | | | | | | 15-17 | | | | | | 18 | | | | | | 19-30 | | | | | | 19-23 | | | | | | 24 | | | | | | 24 | | | | | | 25-26 | | | | | | 27 | | | | | | 28 | | | | | | 28 | | | | | | 29-30 | | | | | | 31 | | | | | | 32 | | | | | | 33 | |

PROXY STATEMENT

of

RAVEN INDUSTRIES, INC.

205 E. 6th Street,

P.O. Box 5107

Sioux Falls, South Dakota 57117-5107

Annual Meeting of Shareholders to be held

May 25, 201023, 2013 GENERAL

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Raven Industries, Inc. (the “Company” or “Raven”) to be used at the Annual Meeting (the “Meeting”) of Shareholders of the Company, which is to be held on Tuesday,Thursday, May 25, 2010,23, 2013, at 9:00 A.M. (C.D.T.) at the Ramkota Hotel and Convention Center, Amphitheater II, 3200 West Maple Avenue, Sioux Falls, South Dakota. The approximate date on which this Proxy Statement and accompanying proxy were first sent or given to shareholders was April 14, 2010.12, 2013. Each shareholder who signs and returns a proxy in the form enclosed with this Proxy Statement may revoke it at any time prior to its use by giving notice of such revocation to the Company in writing or in open meeting or by such shareholder giving a valid proxy bearing a later date. Presence at the meeting by a shareholder who has signed a proxy does not alone revoke the proxy. Only shareholders of record at the close of business on April 7, 20104, 2013 (the “Record Date”) will be entitled to vote at the Meeting or any adjournments thereof.

2VOTING SECURITIES AND PROXIES

The Company has outstanding only one class of voting securities, Common Stock $1.00 par value, of which 18,029,73336,342,098 shares were outstanding as of the close of business on the Record Date. Shareholders representing a majority of the shares of Common Stock outstanding and entitled to vote must be present in person or represented by proxy in order to constitute a quorum to conduct business at the Meeting.

You are entitled to one vote for each share of Common Stock that you hold, except for the election of directors. IfWith respect to the election of directors, if you vote for all nominees, one vote per share will be cast for each of the nineseven nominees. You may withhold votes from any or all nominees. Except for the votes that shareholders of record withhold from any or all nominees, the persons nameddesignated as proxies in the proxy card will vote such proxy “FOR” and, if necessary, will exercise their cumulative voting rights to elect the nominees as directors of the Company. If you wish to cumulate your votes in the election of directors, you are entitled to as many votes as equal the number of shares held by you at the close of business on the Record Date, multiplied by the number of directors to be elected. You may cast, under the cumulative voting option, all of your votes for a single nominee or apportion your votes among any two or more nominees. For example, a holder of 100 shares may cast 900700 votes for a single nominee, apportion 100 votes for each of nineseven nominees or apportion 900700 votes in any other manner by so noting in the space provided on the proxy card. The cumulative voting feature for the election of directors is also available by voting in person at the Meeting; it is not available by telephone or on the internet.

In the election of directors, the nineseven director nominees who receive the highest number of votes will be elected as directors. Other matters requireIn the advisory vote on our executive compensation and the vote to ratify the appointment of the independent registered public accounting firm, the approval requires the affirmative vote of a majority of the votes cast. A shareholder thatcast at a meeting at which a quorum is present or represented by proxy at the Meeting and who “abstains” with respect to this proposal is in effect casting a negative vote, but a shareholder (including a broker) who does not give authority to a proxy to vote will not be considered present and entitled to vote on this proposal.present. 1

YOUR VOTE IS IMPORTANT. BENEFICIAL OWNERS OF SHARES HELD IN BROKER ACCOUNTS ARE ADVISED AS FOLLOWS IN CONNECTION WITH A CHANGE IN APPLICABLE RULES AS OF JANUARY 1 2010: IF YOU DO NOT TIMELY PROVIDE INSTRUCTIONS TO YOUR BROKER, YOUR SHARES WILL NOT BE VOTED IN CONNECTION WITH THE ELECTION OF DIRECTORS.

Effect of Not Casting Your Vote. If you hold your shares in street name it is critical that you cast your vote if you want it to count in the election of directors (Proposal One). In the past, if you held your shares in street name and you did not indicate how you wanted your shares voted in the election of directors, your bank or broker was allowed to vote those shares on your behalf in the election of directors as they felt appropriate. Recent changes in regulations were made to take away the ability of your bank or broker to vote your uninstructed shares in the election of directors on a discretionary basis. As a result, if you hold your shares in street name and you do not instruct your bank or broker how to vote in the election of directors, no votes will be cast on your behalf. Also, without such instructions, your bank or broker will continue not to have authority to cast votes on your behalf on the approval of the 2010 Stock Incentive Plan (Proposal Two). Your bank or broker will continue to have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal Three).

2

2OWNERSHIP OF COMMON STOCK

The following table shows certain information regarding beneficial ownership of the Company’sCompany's common stock as of the Record Date by: (i) any person known by the Company to be the owner, of record or beneficially, of more than 5% of the Common Stock, (ii) each of the executive officers, directors and nominees for election to the Company’sCompany's Board of Directors, and (iii) all executive officers and directors as a group. | | | | | | | | | | | | | | | Name | | | | | | Shares | | | | of beneficial | | Stock units | | beneficially | | Percent | | owner | | Vested | | owned | | of class | | David R. Bair | | | | | | | 38,938 | (1) | | | * | | | Anthony W. Bour | | | 5,098 | | | | 55,122 | (13) | | | * | | | Matthew T. Burkhart | | | | | | | 2,700 | (2) | | | * | | | David A. Christensen | | | 2,607 | | | | 445,099 | (3,13) | | | 2.5 | | | Thomas S. Everist | | | 2,607 | | | | 12,200 | (13) | | | * | | | Mark E. Griffin | | | 2,607 | | | | 98,980 | (4,13) | | | * | | | James D. Groninger | | | | | | | 27,722 | (5) | | | * | | | Conrad J. Hoigaard | | | 2,607 | | | | 100,000 | (13) | | | * | | | Thomas Iacarella | | | | | | | 126,084 | (6) | | | * | | | Kevin T. Kirby | | | 1,915 | | | | 10,000 | (13) | | | * | | | Cynthia H. Milligan | | | 3,785 | | | | 6,124 | (13) | | | * | | | Ronald M. Moquist | | | | | | | 838,832 | (7) | | | 4.6 | | | Barbara K. Ohme | | | | | | | 35,473 | (8) | | | * | | | Daniel A. Rykhus | | | | | | | 56,716 | (9) | | | * | | | Mark L. West | | | | | | | 75,382 | (10) | | | * | | T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202 | | | | | | | 2,384,300 | (11) | | | 13.2 | | Neuberger Berman, Inc. LLC

605 Third Avenue

New York, NY 10158 | | | | | | | 2,243,180 | (12) | | | 12.4 | | All executive officers, directors

and nominees as a group (15 persons) | | | 21,226 | | | | 1,929,372 | (13,14) | | | 10.6 | |

| | | | | | | | | | | | Name of beneficial owner | | Non-voting stock units vested | | Shares beneficially owned | | | Percent of class | | Jason M. Andringa | | — |

| | — |

| |

|

| * | | | | | | | | | | | Anthony W. Bour | | 17,275 |

| | 110,242 |

| | (1,12) |

| * | | | | | | | | | | | Matthew T. Burkhart | | | | 40,985 |

| | (2) |

| * | | | | | | | | | | | Thomas S. Everist | | 8,762 |

| | 24,400 |

| | (12) |

| * | | | | | | | | | | | Mark E. Griffin | | 8,762 |

| | 21,664 |

| | (12) |

| * | | | | | | | | | | | Thomas Iacarella | | | | 279,833 |

| | (3) |

| * | | | | | | | | | | | Kevin T. Kirby | | 7,269 |

| | 20,000 |

| | (12) |

| * | | | | | | | | | | | Marc E. LeBaron | | 3,812 |

| | 2,000 |

| | (12) |

| * | | | | | | | | | | | Janet L. Matthiesen | | | | 5,084 |

| | (4 | ) | * | | | | | | | | | | | Cynthia H. Milligan | | 11,305 |

| | 14,248 |

| | (12) |

| * | | | | | | | | | | | Daniel A. Rykhus | | | | 197,223 |

| | (5) |

| * | | | | | | | | | | | Stephanie Herseth Sandlin | | | | — |

| | | * | | | | | | | | | | | Anthony D. Schmidt | | | | 29,802 |

| | (6) |

| * | | | | | | | | | | | Lon E. Stroschein | | | | 23,100 |

| | (7) |

| * | | | | | | | | | | T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 | | | | 4,748,800 |

| | (8) |

| 13.1 | | | | | | | | | | Neuberger Berman Group LLC 605 Third Avenue New York, NY 10158 | | | | 4,331,533 |

| | (9) |

| 11.9 | | | | | | | | | | The Vanguard Group, Inc. 100 Vanguard Blvd Malvern, PA 19335 | | | | 2,164,282 |

| | (10) |

| 6.0 | | | | | | | | | | BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | | | 1,945,903 |

| | (11) |

| 5.4 | | | | | | | | | | All executive officers, directors and nominees as a group (14 persons) | | | | 768,581 |

| | (12,13) |

| 2.1 | | * Less than 1% | | | | | | | |

3

| | | (1) | | Includes 14,750 shares that may be purchased within 60 days by exercise of outstanding options. | | (2) | | Includes 1,950 shares that may be purchased within 60 days by exercise of outstanding options. | | (3) | | Includes 196,395 shares owned by his wife, as to which he disclaims beneficial ownership. | | (4) | | Includes 79,996 shares held by the John E. Griffin Trust, of which Mark E. Griffin is co-trustee, and 8,152 shares held as custodian for a minor child. | | (5) | | Includes 16,100 shares that may be purchased within 60 days by exercise of outstanding options. | | (6) | | Includes 18,175 shares that may be purchased within 60 days by exercise of outstanding options. | | (7) | | Includes 29,400 shares that may be purchased within 60 days by exercise of outstanding options. Also includes 126,000 shares held by his wife, as to which he disclaims beneficial ownership. | | (8) | | Includes 10,350 shares that may be purchased within 60 days by exercise of outstanding options. | | (9) | | Includes 17,750 shares that may be purchased within 60 days by exercise of outstanding options. | | (10) | | Includes 11,825 shares that may be purchased within 60 days by exercise of outstanding options. | | (11) | | Data based on Schedule 13G filed by the shareholder with the SEC on February 12, 2010, in which the shareholder stated: “These securities are owned by various individual and institutional investors, including T. Rowe Price Small-Cap Value Fund, Inc. (which owns 2,144,500 shares,...) which T. Rowe Price Associates, Inc. (Price Associates) serves as investment advisor with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities.” | | (12) | | Data based on Schedule 13G filed by the shareholder with the SEC on February 16, 2010. | | (13) | | Does not include non-voting vested Stock Units held by the Deferred Compensation Plan for Directors. | | (14) | | Includes 120,300 shares that may be purchased within 60 days by exercise of outstanding options. Also includes 322,395 shares held by spouses of officers and directors, as to which beneficial ownership is disclaimed. |

4

(1) Includes 62,540 shares held in a series of grantor annuity trusts for the benefit of Mr. Bour and his adult children and 47,702 shares held in irrevocable trusts for the benefit of his adult children. Mr. Bour is a co-trustee of the Children's Trusts.

(2) Includes 32,821 shares that may be purchased within 60 days by exercise of outstanding options.

(3) Includes 52,225 shares that may be purchased within 60 days by exercise of outstanding options.

(4) Includes 5,000 shares that may be purchased within 60 days by exercise of outstanding options.

(5) Includes 103,700 shares that may be purchased within 60 days by exercise of outstanding options.

(6) Includes 16,800 shares that may be purchased within 60 days by exercise of outstanding options.

(7) Includes 20,728 shares that may be purchased within 60 days by exercise of outstanding options.

(8) Data based on Schedule 13G filed by the shareholder with the SEC on February 8, 2013.

(9) Data based on Schedule 13G filed by the shareholder with the SEC on February 14, 2013.

(10) Data based on Schedule 13G filed by the shareholder with the SEC on February 11, 2013.

(11) Data based on Schedule 13G filed by the shareholder with the SEC on February 11, 2013.

(12) Does not include non-voting vested Stock Units held by the Deferred Compensation Plan for Directors.

(13) Includes 231,274 shares that may be purchased within 60 days by exercise of outstanding options.

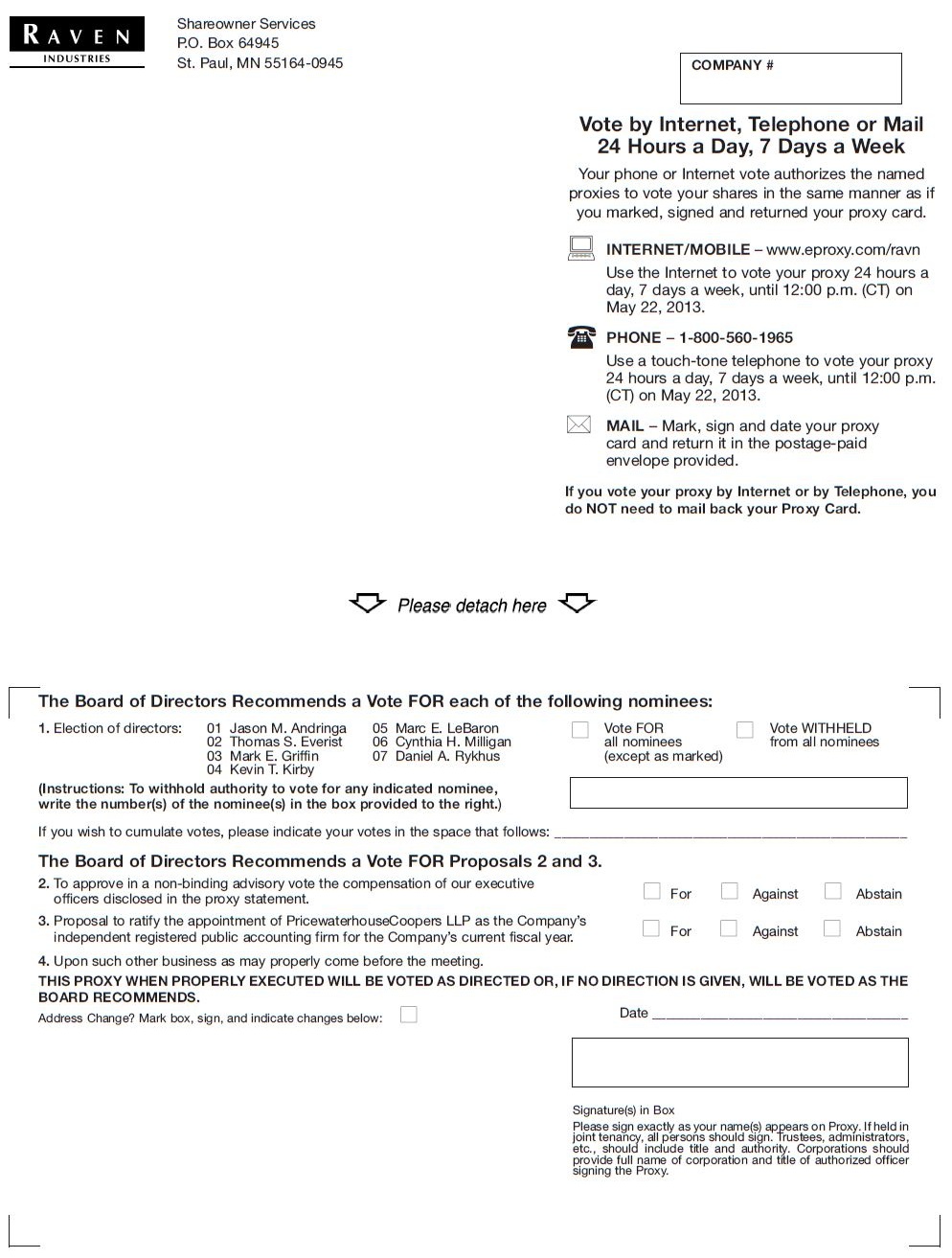

ELECTION OF DIRECTORS 2Proposal No. 1

Director Nominees and Qualifications.NineSeven directors are to be elected at the Meeting, each director to serve until the next Annual Meeting of Shareholders. All of the nominees listed below (except Mr. Andringa) are now serving as directors and all of the nominees have agreed to serve.

The following paragraphs provide information as of the date of this proxy statement about each nominee. The information presented includes information each director has given us about his or her age, all positions he or she holds within the Company, his or her principal occupation and business experience for the past five years, the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years, and whether each director is independent. Independence has been determined according to Nasdaq listing standards.

As described below under “Corporate Governance —- Nominations to the Board of Directors”,Directors," in considering nominations to the Board of Directors, the Governance Committee of the Board considers such qualities as the individual’sindividual's experience, character, integrity and other factors. As a whole, the Board believes the current Board is composed of directors who bring diverse experiences and backgrounds relevant to the Company’sCompany's business; who form a balanced core of business executives with varied expertise; who have substantial experience outside the business community, and who will represent the balanced, best interests of the shareholders as a whole. We also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our Company and our Board. Each nominee’snominee's description below includes information regarding each nominee’snominee's specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director.

| | | | | Name of Nominee (Age) | | | Director Since Director Independence | | Principal Occupation, Business Experience and Directorships in PublicCompanies in Past Five Years, and Qualifications to Serve as a Director of Raven | Director Independence | | Anthony W. Bour (72)

1995

Jason M. Andringa (37) Nominee Independent Director | | Mr. Bour has beenAndringa is President of Forage & Environmental Solutions for the Vermeer Corporation, Pella, Iowa. The Vermeer Corporation manufactures equipment for the construction, agriculture, surface mining, forestry and Chief Executive Officer of Showplace Wood Products, Harrisburg, SD since 1999. Showplace is a manufacturer of custom cabinetry, servinglandscaping industries and serves markets around the North American market and sourcing raw materials worldwide. He is a director of U.S. Bank of South Dakota, Sioux Falls, SD. Mr. Bour has over 30 years of experience as CEO of a manufacturing company locatedworld. Prior to his current role in the Company’s home state, along with extensive knowledgecompany, Mr. Andringa also served as Vice President for Dealer Distribution and Global Accounts and was based in the Netherlands while serving as Managing Director for Europe, the Middle East and Africa. He brings a strong understanding of manufacturing and distribution issues.operations and substantial experience in both domestic and international markets. Prior to joining Vermeer, Mr. Andringa was a staff engineer for four years at NASA's Jet Propulsion Laboratory where he applied his Master of Science in Aeronautics and Astronautics from MIT. In addition to his board membership for a number of Vermeer subsidiaries, Mr. Bour directly supervisesAndringa also serves on the CFOBoard of Showplace,Advisors for Camcraft and has an understandingthe Board of accounting principles, internal controlsTrustees for The Nature Conservancy of Iowa. Mr. Andringa's educational and audit committee functions;professional background qualifies him to serve as a result he is considered an “audit committee financial expert.”director and provides valuable business and strategic insight to the Board. | | | | | David A. Christensen (75)

1971

Independent Director | | Mr. Christensen was President and Chief Executive Officer of the Company from 1971 to 2000. He was also previously a Director of Xcel Energy, Inc. Minneapolis, MN (1976 – 2005); and of Wells Fargo & Co., San Francisco, CA (1977-2003). Mr. Christensen meets the age criterion for Directors because he was 74 years old when nominated by the Governance Committee in March 2010. He is a significant shareholder of the Company. Mr. Christensen served as our CEO for 29 years, and his 48 years of service to our Company gives him a unique perspective on the Company’s history and business. |

5

| | | Name of Nominee (Age) | | | Director Since | | Principal Occupation, Business Experience and Directorships in PublicCompanies in Past Five Years, and Qualifications to Serve as a Director of Raven | Director Independence | | Thomas S. Everist (60)

(63)1996

Independent Director | | Mr. Everist was named Chairman of the Board of the Company on April 1, 2009. He is President and Chief Executive Officer of The Everist Company, Sioux Falls, SD.SD, a position he has held since 2002. He was President and Chief Executive Officer, L.G. Everist, Inc., Sioux Falls, SD, from 1987 to 2002. These companies mine and produce construction materials including aggregate, concrete and asphalt. He brings a strong understanding of production and logistical operations. Since 2006, he has been the managing member of South Maryland Creek Ranch, LLC, a land development company, and President of SMCR, Inc., an investment company. He is a director of MDU Resources, Bismarck, ND, a publicallypublicly traded energy and utility company, where he chairs the Compensation Committee. He is also a director of several non-public companies including, Showplace Wood Products, Bell, Inc. and Everist Genomics, Inc. Mr. Everist brings demonstrated success in business and leadership skills, serving as president and chairman of his companies, headquartered in the Company’sCompany's home state, for over 2225 years. | | | |

| | | Name of Nominee (Age) Director Since Director Independence | Principal Occupation, Business Experience and Directorships in Public Companies in Past Five Years, and Qualifications to Serve as a Director of Raven | Mark E. Griffin (59)

(62) 1987

Independent Director | | Mr. Griffin has been President and Chief Executive Officer of Lewis Drugs, Inc., Sioux Falls, SD since 1986. Lewis Drugs is a regional retail department and drug store chain. He is a board member of the National Association of Chain Drug Stores. He is also President and Chief Executive Officer of Griffson Realty Company, Fredin Associates and G.E.F. Associates, Sioux Falls, SD. Mr. Griffin brings over 20 years of experience as a CEO of a significant retail business and a real estate company, among other businesses, in the Company’sCompany's home community. Not only does he bring extensive operations, marketing and distribution experience, but he also has a valuable perspective on local issues involving real estate, work force and other matters. | | | | | Conrad J. Hoigaard (73)

1976

Independent Director | | Mr. Hoigaard was Chairman of the Board of the Company from 1980 to 2009. He has been President and Chairman of the Board of Hoigaard’s Inc., Minneapolis, MN since 1972. Hoigaard’s is a sporting goods retailer. Mr. Hoigaard’s family helped provide the initial capital for the Company at its founding and has held a significant share position in Raven Industries since that time. Mr. Hoigaard brings a valuable perspective from running a significant business in a major metropolitan area and has been associated with the Company for 34 years. | | | | Kevin T. Kirby (55)

(58) 2007

Independent Director | | Mr. Kirby has been the Presidentis CEO and a director of Kirby Investment Corporation, Sioux Falls, SD since 1993. He is also Chairman of Twelve-step Living Corporation,Face It TOGETHER, a non-profit organization. He was the Executive Vice President and Treasurer of Western Surety Company from 1979 to 1992. In this position he developed an understanding of accounting principles, internal controls and audit committee functions; as a result he is considered an “audit committee financial expert”.expert." He was elected a Director of the Company in 1989 and resigned his position in 2001. From 1993-2001 he chaired the Raven Audit Committee. He was asked to rejoin the Board in 2007. Mr. Kirby brings to the Board over 30 years of expertise in corporate finance and investment management, as well as an insurance background, and provides a valuable risk management perspective. | | | | Marc E. LeBaron (58) 2011 Independent Director | Mr. LeBaron has been Chairman/CEO of Lincoln Industries in Lincoln, NE since 2001. Lincoln Industries is a supplier of products requiring high performance metal finishing. He has served on the Board of Directors of Ballantyne Strong, Inc. since 2005. He serves on Ballantyne's Audit Committee, Compensation Committee and Nominating and Governance Committees. He is also a director of Assurity Security Group, Inc., Lincoln, NE. Mr. LeBaron brings his experience as the CEO of a Midwestern ISO certified manufacturer, recognized as one of the best places to work in America. His organizational leadership experience, ability to identify and implement business strategy and knowledge of corporate governance give him the operational expertise and breadth of knowledge which qualify him to serve as director. | | | Cynthia H. Milligan (63)

(66) 2001

Independent Director | | Mrs. Milligan is Dean Emeritus of the College of Business Administration University of Nebraska-Lincoln. She was Dean from 1998 until her retirement in 2009. She has been an adjunct professor at Georgetown University Law CollegeCenter and the University of Nebraska College of Law. She was the Director of Banking and Finance for the state of Nebraska from 1987 to 1991, supervising several hundred financial institutions. This experience has given her an understanding of accounting principles, internal controls and audit committee functions; as a result she is considered an “audit committee financial expert”.expert." She is a Director of Wells Fargo and Co., San Francisco, CA; and Calvert Funds, Bethesda, MD. She serves on the Audit and Governance Committees of Calvert Funds, Bethesda, MD and Kellogg Company serving on the Social Responsibility & Public Policy Committee and the Consumer & Shopper Marketing Committee. She serves on the Risk, Governance & Nominating Committee and Corporate Responsibility Committees at Wells Fargo and chairs the Credit Committee. Mrs. Milligan’sMilligan's educational and governmental background provides valuable business, regulatory and legal insights to the Board. |

6

| | | Name of Nominee (Age) | | | Director Since | | Principal Occupation, Business Experience and Directorships in PublicCompanies in Past Five Years, and Qualifications to Serve as a Director of Raven | Director Independence | | Ronald M. Moquist (64)

1999

Daniel A. Rykhus (48) 2008 Not Independent | | Mr. Moquist has beenRykhus was named President and Chief Executive Officer of the Company since 2000. From 1985 to 2008 he was Executive Vice President of the Company. During his tenure the Company’s market capitalization has grown tenfold. He joined the Company in 1975 as Saleson August 20, 2010 and Marketing Manager. He currently serves as a director of the South Dakota Chamber of Commerce and Industry, Sioux Empire United Way and South Dakota Voices for Children and is Chairman of the Board of Trustees of the Sanford Health System in Sioux Falls, SD. He is also a director of the National Association of Manufacturers, Washington, DC. The Board believes that Mr. Moquist is an appropriate representative of management on the Board given his position as the Company’s principal executive officer and his long tenure with the Company, which dates back to 1975. In addition, Mr. Moquist brings a wealth of industry experience to the Board. | | | | Daniel A. Rykhus (45)

2008

Not Independent | | Mr. Rykhus hashad been Executive Vice President of the Company since 2004. He was the General Manager of the Applied Technology Division from 1998 through 2009, growing the division’sdivision's sales from $15 million to over $100 million. He joined the Company in 1990 as Director of World Class Manufacturing. He serves on the boards of Great Western Bank, the Washington Pavilion and Sioux Empire Junior Achievement,many other non-profit organizations in Sioux Falls, SD. The Board believes that Mr. Rykhus is an appropriate representative of management on the Board given his position as a senior executive officer and his long tenure with the Company, which dates back to 1990.Company. In addition, Mr. Rykhus brings a wealth of industry experience to the Board. |

All shares represented by proxies will be votedFORall the previously named nominees unless a contrary choice is specified. If any director nominee should withdraw or become unavailable to serve for reasons not presently known, the proxies that would otherwise have been voted for such nominee will be voted for a substitute nominee that may be selected by the Governance Committee of the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEUFORU ALL NOMINEES. 7

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION (SAY ON PAY) APPROVAL OF THE RAVEN INDUSTRIES, INC. 2010 STOCK INCENTIVE PLAN

Proposal No. 2 We are asking our shareholders The Company's executive compensation program is designed to approve the Raven Industries, Inc. 2010 Stock Incentive Plan (the “Plan”). Our Board of Directors adopted the Plan on March 20, 2010, subject to shareholder approval. The Shareholder approval of the Plan would allow up to 500,000 shares of Raven Common Stock to be issued, subject to adjustment in the event of a merger, recapitalization or other corporate restructuring. This represents 2.8% of the shares outstanding on March 20, 2010. The Company currently has the authority to award stock options, restricted stock and other equity awards under the Company’s 2000 Stock Option and Compensation Plan (the “2000 Plan”). The 2000 Plan terminates on May 24, 2010. The original share reserve under the 2000 Plan was 1,500,000 shares of common stock. As of March 20, 2010, 396,550 shares were subject to outstanding stock options under the 2000 Plan, and 255,025 shares remained available for further grants under the 2000 Plan. Following shareholder approval of the Plan, no further awards will be made under the 2000 Plan. Nevertheless, any award earlier granted under the 2000 Plan will continue to be governed by the terms of that plan. The following is a summary of the material terms of the Plan and is qualified in its entirety by reference to the Plan, a copy of which is attached to this Proxy Statement as Exhibit A.

Description of the Plan

General

The purpose of the Plan is to increase shareholder value and to advancealign the interests of the Companyexecutive team with those of Raven shareholders. The Board believes this alignment is demonstrated by furnishingthe Company's excellent financial results in recent periods. “Compensation Discussion and Analysis” that begins on page 12, explains our compensation programs in more detail. In summary, the shareholders should approve our executive compensation for the following reasons, among others:

Our executive compensation program uses salary and benefits, a variety of economic incentives designedmanagement incentive program and a long-term incentive plan to attract,achieve our goals, with a focus on tying compensation to corporate performance while remaining competitive to retain and motivate employees, certain key consultantsattract an outstanding management team. In fiscal 2013, we worked with an independent compensation consultant to evaluate our compensation relative to our peers and directorsto modify our long-term incentive compensation program to incorporate performance-based restricted stock units, tying compensation more closely to corporate performance that enhances shareholder value. Raven's record financial performance and growth this year matches well with the changes in executive pay. When Raven had lower results in fiscal 2010, executive compensation was sharply lower than in earlier and subsequent years. Raven shareholders have seen, over the past five years, a $100 investment grow to $201.51 compared to $152.92 for the S&P 1500 Industrial Machinery or $135.81 for the Russell 2000 indexes. Our company has managed the transition to a new CEO with no significant disruption.

At the annual meeting, the shareholders will be given the opportunity to vote for or against a non-binding resolution to approve the compensation of the Company. The compensation committee of the Company’s Board of Directors administers the Plan. The compensation committee may grant Incentives to employees (including officers)named executive officers of the Company, or its subsidiaries, membersas described in Compensation Discussion and Analysis and the tabular and narrative disclosure regarding executive compensation contained in this proxy statement pursuant to the compensation disclosure rules of the Board of Directors,Securities and consultants or other independent contractors who provide services toExchange Commission. For the Company or its subsidiaries, in the following forms, each of which is discussed below: (a) non-statutory stock options and incentive stock options; (b) stock appreciation rights (“SARs”); (c) stock awards; and (d) restricted stock. Eligible Participants

Employees (including officers) of the Company and its subsidiaries, members ofreasons described above, the Board of Directors and consultants or other independent contractors who provide servicesrecommends that shareholders vote to approve the Company or its subsidiaries are eligible to receive Incentives under the Plan, as described below, when designated by theexecutive compensation committee.

8

Description of Incentives

Stock Options.The compensation committee may grant non-qualified and incentive stock options to eligible employees to purchase shares of common stock from the Company. The Plan confers on the compensation committee discretion, with respect to any such stock option, to determine the term of each option, the time or times during its term when the option becomes exercisable and the number and purchase price of the shares subject to the option. However, the option price per share may not be less than the fair market value of the common stock on the grant date.

Stock Appreciation Rights.A stock appreciation right or “SAR” is a right to receive, without payment to the Company, a number of shares, cash or any combination thereof, the amount of which is equal to the aggregate amount of the appreciation in the shares of common stock as to which the SAR is exercised. For this purpose, the “appreciation” in the shares consists of the amount by which the fair market value of the shares of common stock on the exercise date exceeds (a) in the case of a SAR related to a stock option, the purchase price of the shares under the option or (b) in the case of an SAR granted alone, without reference to a related stock option, an amount determined by the compensation committee at the time of grant. The compensation committee has the discretion to determine the number of shares as to which a SAR will relate as well as the duration and exercisability of a SAR. However, the exercise price may not be less than the fair market value of the common stock on the grant date.

Stock Awards.Stock awards consist of the transfer by the Company to an eligible participant of shares of common stock, without payment, as additional compensation for services to the Company. The number of shares transferred pursuant to any stock award is determined by the compensation committee.

Restricted Stock.Restricted stock consists of the sale or transfer by the Company to an eligible participant of one or more shares of common stock that are subject to restrictions on their sale or other transfer by the employee which restrictions will lapse after a period of time as determined by the compensation committee. The price at which restricted stock will be sold, if any, will be determined by the compensation committee, and it may vary from time to time and among employees and may be less than the fair market value of the shares at the date of sale. Subject to these restrictions and the other requirements of the Plan, a participant receiving restricted stock shall have all of the rights of a stockholder as to those shares.

Transferability of Incentives

Incentives granted under the Plan may not be transferred, pledged or assigned by the holder thereof except, in the event of the holder’s death, by will or the laws of descent and distribution to the limited extent provided in the Plan or the Incentive, or pursuant to a qualified domestic relations order as defined by the Code or Title I of the Employee Retirement Income Security Act, or the rules thereunder. However, stock options may be transferred by the holder thereof to the holder’s spouse, children, grandchildren or parents (collectively, the “Family Members”), to trusts for the benefit of Family Members, to partnerships or limited liability companies in which Family Members are the only partners or stockholders.

9

Amendment of the Incentive Plan and Incentives

The Board of Directors may amend or discontinue the Plan at any time. However, no such amendment or discontinuance may adversely change or impair a previously granted Incentive without the consent of the recipient thereof. Certain Plan amendments require stockholder approval, including amendments which would increase the maximum number of shares of common stock which may be issued to all participants under the Plan, change or expand the types of Incentives that may be granted under the Plan, change the class of persons eligible to receive Incentives under the Plan, or materially increase the benefits accruing to participants under the Plan.

Generally, the terms of an existing Incentive may be amended by agreement between the Committee and the participant. However, in the case of a stock option or SAR, no such amendment shall (a) without shareholder approval, lower the exercise price of a previously granted stock option or SAR, or (b) extend the term of the Incentive, with certain exceptions.

Change in Control; Effect of Sale, Merger, Exchange or Liquidation

Upon the occurrence of an event satisfying the definition of “Change in Control” with respect to a particular Incentive, unless otherwise provided in the agreement for the Incentive, such Incentive shall become vested and all restrictions shall lapse. The Committee may, in its discretion, include such further provisions and limitations in any agreement for an Incentive as it may deem desirable. For purposes of this Section 9.13, “Change in Control” means the occurrence of any one or more of the following: (a) the acquisition by any individual, entity or group of beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of more than thirty percent (30%) of the outstanding voting power of the Company entitled to vote in the election of directors;providedthat a Change in Control shall not be deemed to occur solely because more than thirty percent (30%) of the outstanding voting shares is acquired by a trustee or other fiduciary holding securities under one or more employee benefit plans maintained by the Company or any of its subsidiaries; (b) a merger, consolidation or other reorganization involving the Company if the shareholders of the Company and their affiliates, immediately before such merger, consolidation or other reorganization, do not, as a result of such merger, consolidation, or other reorganization, own directly or indirectly, more than fifty percent (50%) of the voting equity securities of the successor entity; (c) a majority of the members of the Board of Directors is replaced within a period of less than two years by directors not nominated and approved by the Board of Directors; or (d) the sale or other disposition of all or substantially all of the assets of the Company and its subsidiaries determined on a consolidated basis, or a complete liquidation or dissolution of the Company.

Unless otherwise provided in

Because the agreement for an Incentive, in the event of an acquisition of the Company through the sale of substantially all of the Company’s assets or through a merger, exchange, reorganization or liquidation of the Company or a similar event as determined by the compensation committee (collectively a “transaction”), the compensation committee shall be authorized, in its sole discretion, to take any and all actionvote is advisory, it deems equitable under the circumstances, including but not limited to any one or more of the following: (1) terminating the Plan and all Incentives and issuing the holders of outstanding vested options and SARs the stock, securities or assets they would have received if the Incentives had been exercised immediately before the transaction, (2) providing that participants holding outstanding vested common stock-based Incentives shall receive, at the determination of the compensation committee, cash, securities or other property, in an amount equal to the excess, if any, of the fair market value of the common stock issuable under the Incentives on a date within ten days prior to the effective date of such transaction over the option price or other amount owed by a participant, if 10

any, and that such Incentives shall be cancelled, including the cancellation without consideration of all options that have an exercise price below the per share value of the consideration received by the Company in the transaction; (3) providing that the Plan (or a replacement plan) shall continue with respect to Incentives not cancelled or terminated as of the effective date of such transaction and provide to participants holding such Incentives the right to earn their respective Incentives on a substantially equivalent basis with respect to the equity of the entity succeeding the Company by reason of such transaction; and (4) providing that all unvested, unearned or restricted Incentives, including but not limited to restricted stock for which restrictions have not lapsed as of the effective date of such transaction, shall be void and deemed terminated, or, in the alternative, for the acceleration or waiver of any vesting, earning or restrictions on any Incentive.

Federal Income Tax Consequences

The following discussion sets forth certain United States income tax considerations in connection with the ownership of common stock. These tax considerations are stated in general terms and are based on the Internal Revenue Code of 1986 in its current form and current judicial and administrative interpretations thereof. This discussion does not address state or local tax considerations with respect to the ownership of common stock. Moreover, the tax considerations relevant to ownership of the common stock may vary depending on a holder’s particular status.

An employee who receives restricted stock or performance shares subject to restrictions which create a “substantial risk of forfeiture” (within the meaning of section 83 of the Code) will normally realize taxable income on the date the shares become transferable or are no longer subject to substantial risk of forfeiture or on the date of their earlier disposition. The amount of such taxable income will be equal to the amount by which the fair market value of the shares of common stock on the date such restrictions lapse (or any earlier date on which the shares are disposed of) exceeds their purchase price, if any. An employee may elect, however, to include in income in the year of purchase or grant the excess of the fair market value of the shares of common stock (without regard to any restrictions) on the date of purchase or grant over its purchase price. The Company will be entitled to a deduction for compensation paid in the same year and in the same amount as income is realized by the employee.

An employee who receives a stock award under the Plan consisting of shares of common stock will realize ordinary income in the year that the shares are received in an amount equal to the fair market value of such shares, and the Company will be entitled to a deduction equal to the amount the employee is required to treat as ordinary income. An employee who receives a cash award will realize ordinary income in the year the award is paid equal to the amount thereof, and the amount of the cash will be deductible by the Company.

When a non-qualified stock option granted pursuant to the Plan is exercised, the employee will realize ordinary income measured by the difference between the aggregate purchase price of the shares of common stock as to which the option is exercised and the aggregate fair market value of shares of the common stock on the exercise date, and the Company will be entitled to a deduction in the year the option is exercised equal to the amount the employee is required to treat as ordinary income.

11

Options that qualify as incentive stock options are entitled to special tax treatment. Under existing federal income tax law, if shares purchased pursuant to the exercise of such an option are not disposed of by the optionee within two years from the date of granting of the option or within one year after the transfer of the shares to the optionee, whichever is longer, then (i) no income will be recognized to the optionee upon the exercise of the option; (ii) any gain or loss will be recognized to the optionee only upon ultimate disposition of the shares and, assuming the shares constitute capital assets in the optionee’s hands, will be treated as long-term capital gain or loss; (iii) the optionee’s basis in the shares purchased will be equal to the amount of cash paid for such shares; and (iv) the Company will not be entitled to a federal income tax deduction in connection withbinding upon the exerciseBoard. However, the Personnel and Compensation Committee will take into account the outcome of the option. The Company understands that the difference between the option price and the fair market value of the shares acquired upon exercise of an incentive stock option will be treated as an “item of tax preference” for purposes of the alternative minimum tax. In addition, incentive stock options exercised more than three months after retirement are treated as non-qualified options.vote when considering future executive compensation arrangements.

The Company further understands that if the optionee disposes of the shares acquired by exercise of an incentive stock option before the expiration of the holding period described above, the optionee must treat as ordinary income in the year of that disposition an amount equal to the difference between the optionee’s basis in the shares and the lesser of the fair market value of the shares on the date of exercise or the selling price. In addition, the Company will be entitled to a deduction equal to the amount the employee is required to treat as ordinary income.

If the exercise price of an option is paid by surrender of previously owned shares, the basis of the shares surrendered is carried over to the shares received in replacement of the previously owned shares. If the option is a nonstatutory option, the gain recognized on exercise is added to the basis. If the option is an incentive stock option, the optionee will recognize gain if the shares surrendered were acquired through the exercise of an incentive stock option and have not been held for the applicable holding period. This gain will be added to the basis of the shares received in replacement of the previously owned shares.

When a stock appreciation right granted pursuant to the Plan is exercised, the employee will realize ordinary income in the year the right is exercised equal to the value of the appreciation which he is entitled to receive pursuant to the formula described above, and the Company will be entitled to a deduction in the same year and in the same amount.

The Plan is intended to enable the Company to provide certain forms of performance-based compensation to executive officers that will meet the requirements for tax deductibility under Section 162(m) of the Code. Section 162(m) provides that, subject to certain exceptions, the Company may not deduct compensation paid to any one of certain executive officers in excess of $1 million in any one year. Section 162(m) excludes certain performance-based compensation from the $1 million limitation.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEUFORU Proposal No. 2. 12

RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Proposal No. 3 The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP to serve as the Company’sCompany's independent registered public accounting firm for the fiscal year ending January 31, 2011.2014. While it is not required to do so, our Board is submitting the selection of PricewaterhouseCoopers LLP for ratification in order to ascertain the views of our shareholders with respect to the choice of audit firm. If the selection is not ratified, the Audit Committee will reconsider its selection. Representatives of PricewaterhouseCoopers LLP are not expected to be at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEUFORU Proposal No. 3.

BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors held four regular quarterly meetings, and one special meeting during the last fiscal year. The Company has an Audit Committee, Personnel and Compensation Committee and a Governance Committee. All directors attended at least 75 percent of their Board and Committee meetings. Governance Committee.

| | | | Governance Committee. | | Members: | | Cynthia H. Milligan (Chair) | | | Anthony W. Bour | | | David A. Christensen | | | Thomas S. Everist | | | Mark E. Griffin | | | Conrad J. Hoigaard | | | Kevin T. Kirby Marc E. LeBaron | | | | | Independence: | | All of the Committee members meet the independence requirements of Nasdaq listing standards. | | | | | | Responsibilities: | | The Governance Committee reviews corporate governance standards and nominates candidates for the Board of Directors. It met twicetwo times in fiscal 2010.2013. The Committee is also responsible for assessing the Board’sBoard's effectiveness. It has established policies regarding shareholder communications with the Board, nominations and related party transactions which are available on the Company’sCompany's website, www.ravenind.com. | | | | | | Charter: | | The Charter is available on Raven’sRaven's website, www.ravenind.com. |

13

| | | | Audit Committee. | | Members: | Kevin T. Kirby (Chair) Anthony W. Bour Cynthia H. Milligan | | | | Audit Committee.Independence

| | | | Members: | | Anthony W. Bour (Chair) | | | Kevin T. Kirby | | | Cynthia H. Milligan | | | | Independence

and Financial Expertise: | | The Board has determined that each member of this Committee meets the requirements to be named “audit committee financial experts” as defined by the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. The Committee members also meet the independence requirements of Nasdaq listing standards.standards and the independence standards under Rule 10A-3 under the Securities Exchange Act of 1934. | | | | | Responsibilities: | | The Audit Committee monitors the company’sCompany's procedures for reporting financial information to the public. It held two meetings in fiscal 2010.2013. In addition, there were four quarterly conference calls with management, the independent registered public accounting firm, the committee chair and any committee members who were available to discuss results for the quarter and the company’sCompany's earnings release draft. It is directly responsible for the appointment, compensation and oversight of the independent registered public accounting firm and has the sole authority to appoint or replace the independent registered public accounting firm. The Committee reviews the scope of the annual audit. It also reviews related reports and recommendations and preapproves any non-audit services provided by such firm. The Committee maintains open lines of communication with the Board of Directors, Raven’sRaven's financial management and the independent registered public accounting firm. See the “Audit Committee Report” on page 32.27. | | | | | Charter: | | The charter is available on Raven’sRaven's website, www.ravenind.com. | Personnel and Compensation Committee.

| | Members: | | David A. Christensen (Chair) | | | | | Personnel and Compensation Committee. | | Members: | Mark E. Griffin (Chair) Thomas S. Everist Marc E. LeBaron | | | | Mark E. Griffin | | | Conrad J. Hoigaard | | | | Independence, Insiders

and Interlocks: | | All of the Committee members meet the independence requirements of Nasdaq listing standards. Mr. Christensen is the former President and Chief Executive Officer of the Company and joined the Committee after his retirement. No executive officer of the Company served as a member of the Compensation Committee or Board of Directors of another entity in which one of whose executive officers served on the Company’sCompany's Compensation Committee or Board of Directors during fiscal 2010.2013. | | | | | Responsibilities: | | The Committee reviews the Company’sCompany's executive remuneration policies and practices, and makes recommendations to the Board in connection with compensation matters affecting the Company. It held twothree meetings in fiscal 2010.2013. Compensation matters concerning the Chief Executive Officer and the other executives of the Company were approved by the full Board in executive session, with the Chief Executive Officer excused. See the “Compensation Committee Report” on page 24.17. | | | | | Charter: | | The charter is available on Raven’sRaven's website, www.ravenind.com. |

14

4CORPORATE GOVERNANCE

Leadership Structure.Raven has kept the CEO and Chairman positions separate since 1961. The duties of the Chairman of the Board include collaborating with the CEO to establish an agenda for Board and Shareholder meetings, chairing the meetings, and calling executive sessions, as needed. The Chairman, along with the Governance Committee, leads the

establishment of governance standards. The Chairman also helps facilitate communication among Board members and with Raven management.

The Board does not have a firm policy as to whether the position of the Chair and the position of the CEO should be separate and intends to preserve the freedom to decide what is in the best interests of the company at any point of time. However, the Board does strongly endorse the concept of one of the outside directors being in a position of leadership for the rest of the outside directors.

Nominations to the Board of Directors.The Governance Committee of the Board of Directors seeks to recruit highly skilled and participative candidates who have the ability to strengthen the Board of Directors. The Governance Committee will consider timely presented nominations from shareholders if candidates are qualified. Current directors whose performance, capabilities and experience meet the Company’sCompany's expectations and needs are typically nominated for reelection. In accordance with Raven’s Corporate Governance Standards,Raven's Nominations Policy dated August 28, 2012, directors are not re-nominated after they reach their 75th72nd birthday. The Pursuant to the Company's Articles of Incorporation, the size of the Board shouldshall be between seven and nineeleven members. The Bylaws will provide that the number of directors within the range of seven and eleven members with awill be established by action of the Board. A majority beingof the directors must be independent, members as defined by the Securities and Exchange Commission and the Nasdaq Stock Market. The Company’sCompany's lawyers, investment bankers and others with business links to the Company may not become directors. Interlocking directorships are not allowed.

Recognizing that the contribution of the Board will depend on not only the character and capabilities of the directors taken individually but also on their collective strengths, the Board should be composed of:

| | | | | | | •Ÿ | | Directors chosen with a view toward bringing to the Board diverse experiences and backgrounds relevant to the Company’sCompany's business; | | | | | | | •Ÿ | | Directors who will form a balanced core of business executives with varied expertise; | | | | |

| | | •Ÿ | | Directors who have substantial experience outside the business community —- in the public, academic or scientific communities, for example; and | | | | | | | | •Ÿ | | Directors who will represent the balanced, best interests of the shareholders as a whole rather than special interest groups or constituencies. |

In considering possible candidates for election as a director, the Governance Committee should beis guided in general by the composition guidelines established above and, in particular, by the following:

| | | | | | | •Ÿ | | Each director should be an individual of the highest character and integrity and have an inquiring mind, vision and the ability to work well with others and exercise good judgment; | | | | | | | | •Ÿ | | Each director should be free of any conflict of interest which would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

15

| | • | | | | Ÿ | | Each director should possess substantial and significant experience which would be of particular importance to the Company in the performance of the duties of a director; | | | | | | | | •Ÿ | | Each director should have sufficient time available to devote to the affairs of the Company in order to carry out the responsibilities of a director; and | | | | | | | | •Ÿ | | Each director should have the capacity and desire to represent the balanced, best interests of the shareholders as a whole. |

Consistent with the Company’s bylaws,Company's Bylaws, and the Governance Committee Charter, the Governance Committee will review and consider for nomination any candidate for membership to the Board recommended by a shareholder of the Company, in accordance with the evaluation criteria and selection process described in Proposal No. 1.above. Shareholders wishing to recommend a candidate to the Governance Committee for consideration in connection with an election at a specific annual meeting should notify the Governance Committee well in advance of the meeting date to allow adequate time for the review process and preparation of the proxy statement, and in no event later than the first day of February. Also, shareholders may submit director nominations to bring before the 2014 annual meeting by complying with the advance notice procedures contained in the Company's Amended Bylaws. To submit a timely director nomination for the 2014 annual meeting, see the timing requirements described under the

heading “Other Matters - Procedures for Submitting Shareholder Proposals - Proposals or Director Nominations not Included in the Proxy Statement.”

Risk Oversight.The Board provides oversight as to how management runs the business, including management’smanagement's approach to risk tolerance and risk management. Management is directly responsible for risk management. The Board considers risk management matters in its deliberations on various matters and has delegated aspects of its risk oversight role to certain committees. The Audit Committee considers risk when evaluating the integrity of Raven’sRaven's financial statements. The role of the audit process and internal control systems in monitoring and controlling risk areis also reviewed by the Audit Committee. The Personnel and Compensation Committee evaluates performance of the CEO, including risk tolerance and “tone at the top”.top." This Committee also considers the structure of the Company’sCompany's compensation plans and how they might affect risk tolerance. The Governance Committee considers risk when determining the Board leadership structure, nominating Directors and evaluating Board performance. These Committees, which all consist solely of independent Directors, are empowered to perform independent investigations of Corporatecorporate matters, should the need arise. The full Board reviews legal matters, credit risks, and insurance coverage at least annually with management. The Board also considers the risk implications of Raven’sRaven's business strategies, including its acquisition strategy, along with its execution of those strategies, as the Board monitors overall Company performance.

Code of Ethics.The Board of Directors, through its Governance Committee, has adopted a Code of Conduct that applies to directors, officers and all employees of the Company. The Code of Conduct is available on Raven’sRaven's website at www.ravenind.com.

Certain Relationships and Related Transactions.Mrs. Milligan is on the Board of Directors of Wells Fargo and Co., the parent company of Wells Fargo Bank, N.A., which provides transfer agent and registrar services, and borrowings to the Company under a line of credit. The terms of the services and credit line were considered by management competitive with other resources generally available to the Company. There wereno borrowings under the credit line in fiscal 2010.2013. As of April 7, 2010,4, 2013, Raven has no borrowings, and $1.3had $1.0 million of letters of credit and no other amounts outstanding under the line of credit.

Raven has adopted a written policy governing related party transactions. Under this policy, before effecting or continuing any “related party transaction,” the Audit Committee of the Board must first ratify or approve of the transaction and conclude that the transaction is on terms comparable to those that the Company could reasonably expect in an arm’sarm's length transaction with an unrelated third party. Under the policy, a “related party transaction” is any transaction with a related party other than one generally available to all Company employees or involving an amount less than $25,000. A “related party” is (i) a senior officer or a director, including members of their immediate family, (ii) a holder of 16

more than 5% of our common stock, or (iii) an entity owned or controlled by the persons described in clauses (i) or (ii). The policy is available on Raven’sRaven's website at www.ravenind.com.Hwww.ravenind.comH. The Company’sCompany's relationship with Wells Fargo is reviewed annually under this policy.

Board Diversity.The Board recognizes that diverse backgrounds and experiences are helpful to its deliberations and includes these attributes in its nominations policy outlined in “Corporate Governance —- Nominations to the Board of Directors” above. The Governance Committee seeks candidates for the Board who will represent the balanced, best interests of the shareholders as a whole rather than special interest groups or constituencies. Raven does not have a formal Board Diversitydiversity policy.

Communications with the Board of Directors.The Board of Directors believes that the most efficient means for shareholders and other interested parties to raise issues and questions and to get a response is to direct such communications to the Company through the office of the Secretary of the Company. Other methods are also described in the Investor Relations section of the Company’sCompany's website, www.ravenind.com.Hwww.ravenind.comH. If, notwithstanding these methods, a shareholder or other interested party wishes to direct a communication specifically to the Board of Directors, a letter to the Board is the most appropriate method. To insure that the communication is properly directed in a timely manner, it should be clearly identified as intended for the Board: Raven Industries, Inc.

Attention: Board Communications —- (Director Name if applicable)

P.O. Box 5107

Sioux Falls, SD 57117-5107

The Corporate Secretary’sSecretary's Office will collect and organize all such communications. A summary of communications received will be periodically provided to the Company’sCompany's Governance Committee, who will make the final determination regarding the disposition of any such communication.

The Board believes that the Company should speak with one voice and has empowered management to speak on the Company’sCompany's behalf subject to the Board’sBoard's oversight and guidance on specific issues. Therefore, in most circumstances the Board will not respond directly to inquiries received in this manner but may take relevant ideas, concerns and positions into consideration. 17

NON-MANAGEMENT DIRECTOR COMPENSATION

During fiscal 2010,2013, directors who were not full-time employees of the Company were paid a retainer fee of $20,000$30,000 plus $1,200$1,500 for each regular board meeting and $600$800 for each telephonic or committee meeting. The Chairman of the Board received $1,200 per month in lieu of meeting fees. The Audit Committee Chair received $2,000 annually for quarterly audit updates and other duties.

Directors received a Stock Unit Award under the Deferred Compensation Plan for Directors of Raven Industries, Inc. (the “Deferred"Deferred Stock Plan”Plan") approved by the shareholders on May 23, 2006. Directors receive an automatica grant of Stock Units every year in an amount equal to the amount of the cash retainer$30,000 divided by the closing stock price on the date of the annual meeting. Retainers may also be deferred under this plan. Under the Deferred Stock Plan, amounts are deferred until retirement, or a later date upon the election of the director. Deferred payouts under the Deferred Stock Plan are paid in Raven common stock. Director Compensation Table

| | | | | | | | | | | | | | | | | | | | | Fees Earned or Paid | | | | | | All Other | | | | | | in Cash(1) | | Stock Awards(2) | | Compensation(3) | | Total | | Name | | ($) | | ($) | | ($) | | ($) | | Thomas S. Everist | | | 34,400 | | | | 20,000 | | | | — | | | | 54,400 | | | Anthony W. Bour | | | 30,400 | | | | 20,000 | | | | — | | | | 50,400 | | | David A. Christensen | | | 28,400 | | | | 20,000 | | | | — | | | | 48,400 | | | Mark E. Griffin | | | 28,400 | | | | 20,000 | | | | — | | | | 48,400 | | | Conrad J. Hoigaard | | | 27,800 | | | | 20,000 | | | | — | | | | 47,800 | | | Kevin T. Kirby | | | 28,400 | | | | 20,000 | | | | — | | | | 48,400 | | | Cynthia H. Milligan | | | 27,800 | | | | 20,000 | | | | — | | | | 47,800 | |

| | | (1) | | Mr. Bour deferred $20,000 of his retainer into Stock Units under the Deferred Stock Plan. | | (2) | | Represents 713.78 fully vested Stock Units valued at $28.02 per Unit, the price of Raven common shares on the date of the Award, May 21, 2009. | | (3) | | Does not include perquisites and benefits, which totaled less than $10,000 for each director. |

18

| | | | | | | | | | | Director Compensation Table | | Name | Fees Earned or Paid in Cash(1) | Stock Awards(2)

| All Other Compensation(3) | Total | | ($) | ($) |

| ($) |

| ($) | | Thomas S. Everist | 44,400 |

| 30,000 |

| — |

| 74,400 |

| | Anthony W. Bour | 42,700 |

| 30,000 |

| — |

| 72,700 |

| | Mark E. Griffin | 41,500 |

| 30,000 |

| — |

| 71,500 |

| | Marc E. LeBaron | 41,500 |

| 30,000 |

| — |

| 71,500 |

| | Kevin T. Kirby | 42,300 |

| 30,000 |

| — |

| 72,300 |

| | Cynthia H. Milligan | 39,200 |

| 30,000 |

| — |

| 69,200 |

| | | | | | | (1) Mr. Bour and Mr. LeBaron deferred $30,000 of their retainers into Stock Units under the Deferred Stock Plan. | (2) Represents 909.78 fully vested Stock Units valued at $32.975 per Unit, the price of Raven common shares on the date of the Award, May 22, 2012. | (3) Does not include perquisites and benefits, which totaled less than $10,000 for each director. |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS Overview

Raven’sOverview

Raven's executive compensation program, developed by management and approved by the Personnel and Compensation Committee of the Board of Directors (the “Committee”), is intended to be simple, focused on a few key performance metrics and balanced between: | • | | employees, managers and executives | | | • | | long-term and short-term objectives | | | • | | financial and stock performance | | | • | | cash and equity compensation |

Employees, managers and executives Long-term and short-term objectives Financial and stock performance Cash and equity compensation

The compensation program is designed to align the interests of the executive team with those of Raven shareholders. The plan uses salary and benefits, a management incentive program and stock optionslong-term equity incentives to achieve these goals.goals, with a focus on tying compensation to corporate performance. Retention of top talent and achievement of corporate objectives measure the effectiveness of our compensation plan.

Raven also uses non-compensatory programs, such as annual performance reviews, employee improvementdevelopment and education programs, and succession planning. We believe that these programs are more effective than compensation alone for optimizing talent utilization and executive development.

The Committee engaged an independent compensation consultant to assist with its analysis of fiscal 2013 compensation levels and advise on modifications to the executive compensation program. The consultant's analysis found that despite Raven's strong performance, near the top of comparable companies, executive compensation was well below median levels for the peer group. The consultant recommended that compensation be increased over time to approach such targeted median levels for the peer group. As a result, the Committee did increase compensation levels in fiscal 2013 and is closely monitoring the gap in salary and annual incentives when compared to median levels over time.

The consultant also recommended that long term incentive compensation be modified to strengthen the relationship between corporate financial objectives and compensation levels. In April 2012, the Committee, as recommended by the consultant, approved a long-term incentive plan ("LTIP") for executives and other key employees. The plan reduced the number of stock options and added performance based restricted stock units (RSUs) to the compensation package. The performance goals for the vesting of performance shares under the RSUs are closely tied to the creation of shareholder value.

Raven's financial performance for the year ended January 31, 2013, included record sales and record net income. Although fiscal 2013 growth was below management's expectations, Raven delivered a 12.9% return on sales, 20.3% return on average assets and 29.1% return on beginning shareholders equity. Sales were up 6% and net income rose 4% from the levels in fiscal 2012. Fiscal 2012 results were very strong, with sales and profit growth in excess of 20% and strong returns on sales, assets and equity. We believe our historical investment in business expansion, along with strong management, has contributed to our strong performance in recent periods.

Raven's executive compensation levels have been closely tied to these company performance levels. For fiscal 2013, overall executive compensation levels were relatively flat because growth was below expectations. For fiscal 2012 and 2011, executive compensation increased significantly because annual incentive payments are tied to the improved profitability of the company. Further, the addition of the performance based RSUs will increase the relationship between pay and performance. For the RSUs granted in 2013, vesting and the level of performance shares received will depend on Raven's return on sales over the three year period. The executives will receive further RSU grants every year, with the ultimate amount of compensation realized to be based on long term results.

Other significant changes in compensation levels were related to the promotion of Mr. Rykhus to President and Chief Executive Officer in August 2010 and the need to increase executive compensation to a more competitive level as evidenced by internal and external comparisons.

Objectives of the Company’sCompany's Executive Compensation Program

Alignment with Shareholder Interests Our compensation program is designed to motivate and reward Raven’sRaven's executives to achieve the short and long-term goals that we believe will enhance shareholder value. The short-term goals are embodied in our annual budget. Thesecompensation plans and include income targets, productivity goals,growth and efficient working capital utilization and expense control.utilization. The goals are set to be both challenging and achievable, so as to encourage reasonable risk taking and motivate performance. Building on these short-term objectives, the program also seeks to reward executives for enhancing shareholder value over the long-term. Raven’sRaven's long-term objectives include maximizinggrowing sales and net income and efficiently utilizing invested capital.

In order to strengthen the relationship between corporate financial objectives and compensation levels, and consistent with the advice of the independent consultant, in April 2012, the Committee approved the LTIP, with goals closely tied to the long-term creation of shareholder value.

Retention Retention aspects of the program are designed to take advantage of the experience of Raven executives and avoid unwanted turnover in the executive team. The executive officers identified on the Summary Compensation Table on page 2519 (the “Named Executives”) average over 2114 years experience with Raven. We believe that promotion from within and length of tenure at every level of the organization enhances productivityproductivity.

Internal Equity and reduces compensation cost. Internal EquityCompetitiveness

Raven strongly believes in internal equity.equity and that having competitive compensation policies are critical to talent retention and recruiting. We reviewcompare executive pay to prevent it from becoming disproportionately large when compared to the other key managers and employees. The practiceemployees, both inside Raven and externally. We recognize the risk of internal equity isnot being able to recruit top talent or losing top talent to competitors or others with higher compensation levels. Addressing this risk has been challenging, and the gap between Raven and its peer group continues, as shown by the findings of the benchmarking study by the compensation consultant. Raven's growth strategy and compensation philosophy will be difficult to maintain in today’s compensation environmentsustain if management turnover is high and we are required to recruit from outside Raven to fill key positions. Therefore, the Committee has undertaken to increase executive compensation over time to reach median levels. For example, the targeted compensation under the LTIP is higher than under the previous long term incentive package consisting solely of stock options.

Role of Management, the Personnel and Compensation Committee and Consultants Management hires, retains,

In December 2011, the Committee retained The Delves Group ("Delves") to conduct a competitive compensation analysis of Raven's top nine executives, including the Named Executives. The consultant's report was delivered to the Committee in March 2012.

Subsequent to the report from Delves, Raven's Board of Directors asked for an analysis of board of directors compensation and develops employee talent at every levela review of the organization. Our human resources department and Vice President of Administration obtain competitive survey information for positions and locations throughout the Company. This is the starting point for decisions on compensation.Committee's charter. Delves did not provide any consulting services to Raven tries to maintain compensation in the middle of the relevant range for non-executive positions. Executive compensation is principally driven by taking the compensation levels for non-executive employees and extrapolating to key employees and ultimately the executive team and the Named Executives.management. 19

Our President and Chief Executive Officer recommends executive compensation to the Personnel and Compensation Committee (the “Committee”) for approval annually. He used the information in the Delves report to provide additional perspective to his recommendations. Management's role also included providing information to Delves regarding the strategic direction of the company, its performance goals and perspective on executive compensation objectives and competitiveness. Management also updates peer group information at the request of the Committee.

The Committee approves executive salaries, benefits and stock optionLTIP grants. The Committee’sCommittee's decisions regarding the compensation of our President and Chief Executive Officer are made in executive session. Management

Benchmarking

Delves used data from three sources for comparison to Raven’s executive compensation:

The 2011 General Industry Executive Compensation Survey The 2011 High Technology Executive Compensation Survey Proxy statements from a peer group of 18 companies

In fiscal 2012, management and the Committee dodeveloped a peer group, focusing on companies with size and industry comparable to Raven. Management's initial list was reviewed by Delves for relevance and several adjustments were made to better align

industry groups. The peer group is listed below. The Committee believes that these 18 companies are an appropriate peer group for comparison, as well as a group that is large and diverse enough so that any one company does not usealter the overall analysis. Raven's size was near the peer group median, while returns on assets, equity and invested capital were the highest in the peer group.

The survey data was updated to January 1, 2012, using the peer companies' most recently released proxy statements.

The results of the competitive analysis presented to the Committee in March 2012 showed a significant shortfall in total compensation, consultants because we believe consultants tendwhen compared to raise, ratherthe peer group median levels and other survey data. Therefore, the Committee anticipates that Raven's executive compensation, including base salary and incentive compensation, will rise over an extended period at a faster rate than control,industry averages.

The peer group approved by the level of compensation.Committee is listed below: | | | | | | | ($In millions) | | Company Name | | Revenue* | | | | | ADTRAN, Inc. | | 620.6 |

| | AeroVironment, Inc. | | 325.0 |

| | American Science and Engineering, Inc. | | 203.6 |

| | Astronics Corporation | | 266.4 |

| | API Technologies, Inc. | | 280.8 |

| | Badger Meter Inc. | | 319.7 |

| | Cognex Corporation | | 324.3 |

| | Daktronics, Inc. | | 489.5 |

| | FEI, Co. | | 891.7 |

| | Franklin Electric Co. | | 891.3 |

| | HEICO Corporation | | 897.3 |

| | II-VI, Inc. | | 534.6 |

| | Kaydon Corporation | | 475.2 |

| | Lindsay Corp. | | 551.3 |

| | Micrel, Inc. | | 250.1 |

| | MTS Systems Corp. | | 542.3 |

| | Rogers Corp. | | 498.8 |

| | STR Holdings | | 95.3 |

| | | | | * Represents revenue reported through December 31, 2012 | | |

Components of the Company’sCompany's Executive Compensation Program

Base Salary Salaries for the Named Executives are based on the scope of their responsibilities, performance, experience and potential. The salaries of their peers and subordinates inside and outside the Company arewere considered to be background information when setting salary levels. No formal benchmarking process was conducted. The primary objectives addressed by base salary in the Compensation Program are to retain and attract qualified and experienced executives into these positions. The base salary indicates the basic level of compensation commitment that Raven has to each of the Named Executives and their positions in the Company.